Lead Generation for Equipment Financing & Equipment Leasing Companies

Like many businesses your equipment finance company is probably relying on outbound calling to generate acquisition leads. After all, it’s the way it’s always been done. And when you wanted to grow, more leads meant more sales people doing more cold calling.

One of the problems with the outbound call model is its inherent inefficiency. How many calls does a member of your sales team need to make to find a prospect that is both interested and in-market-now for equipment financing?

Having worked for companies in this space I can tell you it’s a lot. Depending on where the data originates from, the ability to get the decision maker on the phone, the happenstance of them actively looking to finance equipment and being open to a non-bank financing option, that number can reach oppressive heights.

Now imagine what you could do if your sales team was having meaningful conversations with in-market-now prospects rather than spending time on all those wasted dials?

Getting In-Market-Now Prospects to Come to You

I know what you are thinking. If it was that easy to get prospects coming to us we’d be doing it by now. I won’t promise you that it is easy. But I can tell you that business owners are in fact searching for your service, every day, and in droves. And that is the beauty of paid search marketing.

In this day and age when a business owner needs to finance a piece of equipment they inevitably go online to find options using Google, Yahoo and Bing. If you aren’t there, you are allowing your competitors to cherry pick the best prospects right from under your nose.

The right paid search technician can put you in front of business owners searching for equipment financing every day, and get them coming right to your door. They can also teach you how to manage leads effectively to generate a positive ROI on funded volume and fee.

Demographic marketing allows you to target someone that looks similar to your ideal customer. Unfortunately, you never know if they are a true prospect, or if/when they will be in market for financing.

Intent based marketing allows you to target prospects as they enter the consideration and decision stage of the buyer’s journey based off the words and phrases they use in their Google search. Targeting them at the very moment they are in-market for financing.

Just imagine all the prospects searching for financing for various pieces of equipment. You could be marketing to them at the very moment they are in market for financing. This intent based marketing targeting in-market-now prospects is more powerful then demographic marketing can ever hope to be. Plus, it’s linear, tractable and repeatable!

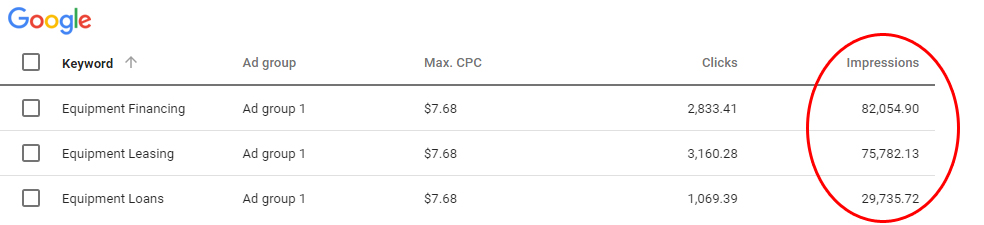

How many prospects are searching for equipment financing, leases or loans in a given month? Below is some data straight from Google to give you a sense of the opportunity in front of you.

Look at how much opportunity you are missing. Above is a small example, and for those three keywords alone Google estimates close to 185,000 related searches (impressions) in one month in the U.S. One. Month.

When you focus your sales team’s efforts on having meaningful conversations with in-market-now prospects instead of marginally effective cold calls you will change the entire trajectory of your financing company.

Imagine adding over $15 to $20 million per year in funded volume and $1 to $2 million per year in funded fee to your acquisition channel from prospects that come to you!

And this is just the impact on acquisition. Factor in the contribution from follow-on retention deals, vendors you can flip from the acquisition deals and referrals generated from new customers and you are talking about a powerful feeder mechanism you can count on year after year to fuel your company’s growth.

Set the Stage for Success. Build a Proper Foundation.

Routing and Managing Inbound Leads

Before you get your paid search program up and running it’s important to remember that processes must be put in place for making sure you get the most out of each lead generated.

You will need to address issues like how the leads are imported into your CRM. How you will route leads to the best sales people in a timely manner. What your campaign name nomenclature will look like. Whether you will tag just the lead, or also the account and any associated opportunity to paid search.

All of this is important in helping to be sure no leads are lost, that they are contacted in a timely fashion, that input errors are kept to a minimum and that full channel reporting will be possible down the line to justify investment in the channel.

Don’t Forget to Integrate Your Sales Team

Even with the best lead management and sales processes in place, you might find that a good portion of your leads will be closed due to no contact. To combat this you will need to be sure your sales team is trained with a very clear set of expectations on how to handle inbound leads. The leads should be imported or input to your CRM immediately, routed to sales just as fast, and called by your sales rep within 5 minutes or less of arriving to give you the best shot at making live contact to qualify the lead.

It’s also critical that your sales team is trained to put any lead into their name and set up proper activities and opportunities tagged to the paid search channel in your CRM to be sure there is proper action and accountability.

If a lead is closed lost, they must be marking it as such and tagging it with the appropriate reason so the account can enter the lead nurture phase for reclamation through marketing automation. After all, it takes a fair amount of effort and resources to generate these leads. You cannot, and must not let them go to waste.

Robust Reporting is Critical

Sure the front end of paid search tools will provide you with a wealth of information on how many conversions you have, what the cost per click or conversion is, your conversion percentage and more. But there is a lot that it won’t tell you that you will need to know. In particular, what happens in the second half of your funnel.

You’ll need a good look at additional metrics to answer questions like how long before a lead is contacted? What is your lead to opportunity and opportunity to deal ratios? What is your revenue generated in first deals and subsequent follow on deals? Which of your sales reps convert the most leads? What are the reasons for leads closed lost and what percentages are they?

This type of information allows you to adjust your strategies and hone your team and processes to be the most effective they can be. The ideal way accomplish this is by importing front end and back end data in to a data warehouse, where you can pull answers from all the important questions into reporting to help manage the program. For the less sophisticated, it’s critical to craft what you can to tie in as much data as you can while working towards a more robust solution. After all, if you want to have confidence in where you invest your marketing dollars, you need to know what’s happening at every phase of the lead conversion process.

The Snowball Effect

Your initial conversion rate on the first lead for a prospect is important in gauging the effectiveness of your efforts. But when marketing for ROI it’s just as important to understand the impact of lead generation today, tomorrow and after the first deal. Sure some deals will close quickly. Others may take more time than your initial sales person has patience for so they move on. And yet others will be cold leads that can be reactivated by your lead nurturing program. Not to mention the impact on your retention and vendor sales from follow on business.

To truly know the impact of paid search lead generation for your equipment finance c

ompany you have to see the snowball that grows as you get better at generating a higher volume and quality of leads. This means slicing and dicing performance and looking at conversion by calendar instead of static, percentage and volume of second and third deals, lifetime funded volume of channel customers and other important performance metrics that will guide your investment over time.

This is the tip of the iceberg when thinking about lead generation and lead nurturing for your equipment finance company. If you are interested in learning more about this powerful lead generation mechanism, contact us to set up a free consultation today.

Want to learn more about how we can help you generate more sales via paid search marketing? Visit our paid search marketing services page.